Ever wondered how your finances rank against other Canadians? The Canadian Payroll Association (CPA) recently published an 11-year study on the financial well-being of Canadians.

As I’m reading the study, all I can think about is David Chilton’s book, The Wealthy Barber. What a great title for a book, eh? That simple title lets you know what this study is basically telling us, it’s not how much you earn, but how much you save.

The study shows that the financial well-being of Canadians has room for improvement. It provides insights into how much (or little) Canadians save. I know we’re financial nerds here at Watermark Stone Wealth, so perhaps our interests are a bit skewed, but the findings were really interesting! For instance, we’ve all done it. Heard the salary of a friend or neighbour, and thought:

If I had an income of ___________ I would be in a much better financial position.”

Turns out, we might be wrong. (I know, first time ever!)

Having a higher income doesn’t guarantee you’ll be financially comfortable.

The CPA study found that while more (45%) of those with a lower income (household of <$50,000) were indeed financially stressed, nearly 20% of those with higher household incomes (>$150,000) were also classified as financially stressed.

It is clear that income alone does not determine financial well-being.”1

So, what does “financially stressed” mean? The study classified respondents into three categories:

Financially Stressed

|

Financially Comfortable

|

Financial CopingThe financial well-being of these folks can be found somewhere in between the traits of the financially stressed and financially comfortable |

Now that we know the definition of being financially stressed, let’s reread that finding: Nearly 20% of those with higher household incomes (>$150,000) were classified as financial stressed.2 Turns out the grass isn’t always greener on the other side of the fence.

Is debt the problem?

We’ve all heard financial experts proport that Canadians have too much debt. A Manulife Bank Debt Survey published on November 21, 2019 found:

The incidence of Canadians who report having considerable non-mortgage related debts increased to 55%, up from 46% in Spring 2019. Canadians who reported having non-mortgage related debts on credit cards increased to 60%, up 12 points over the same period.

Further, Canadians’ spending is outpacing income growth, with only 12% of Canadians saying their income is increasing faster than their spending.”3

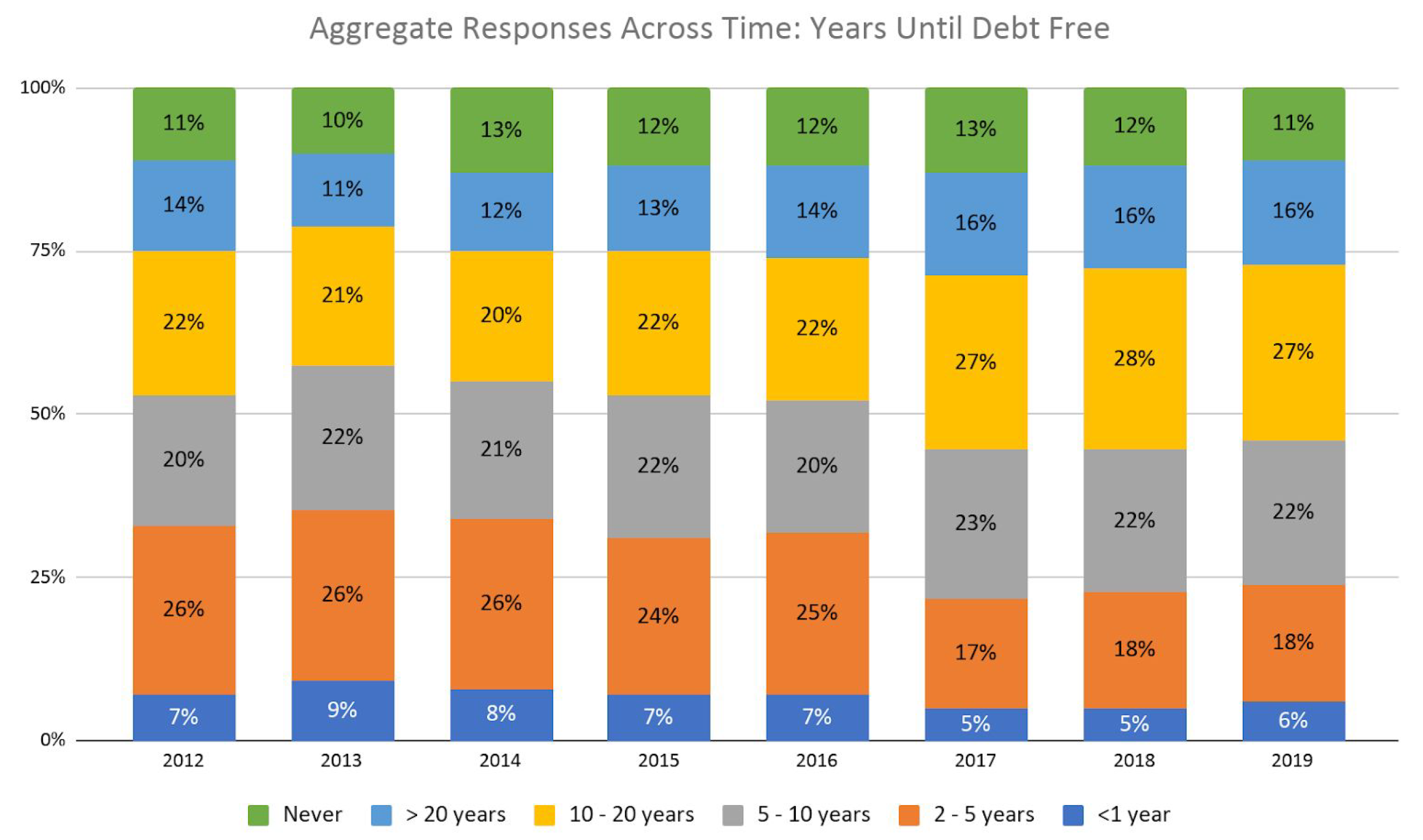

The CPA study found a similar outcome, household debt is a problem. Check out the below chart outlining “years until debt free” responses. In 2012, 26% of respondents said they would be debt free in 2-5 years. While in 2019 only 18% reported the ability to be debt free in 2-5 years. Look further up the 2019 column and you’ll see more individuals in the 10-20 years until debt free category than there were in 2012. Dreary stats for sure!

Source: https://payroll.ca/PDF/Learning-about-Financial-Well-Being-in-Canada-De.aspx

Are we not saving enough?

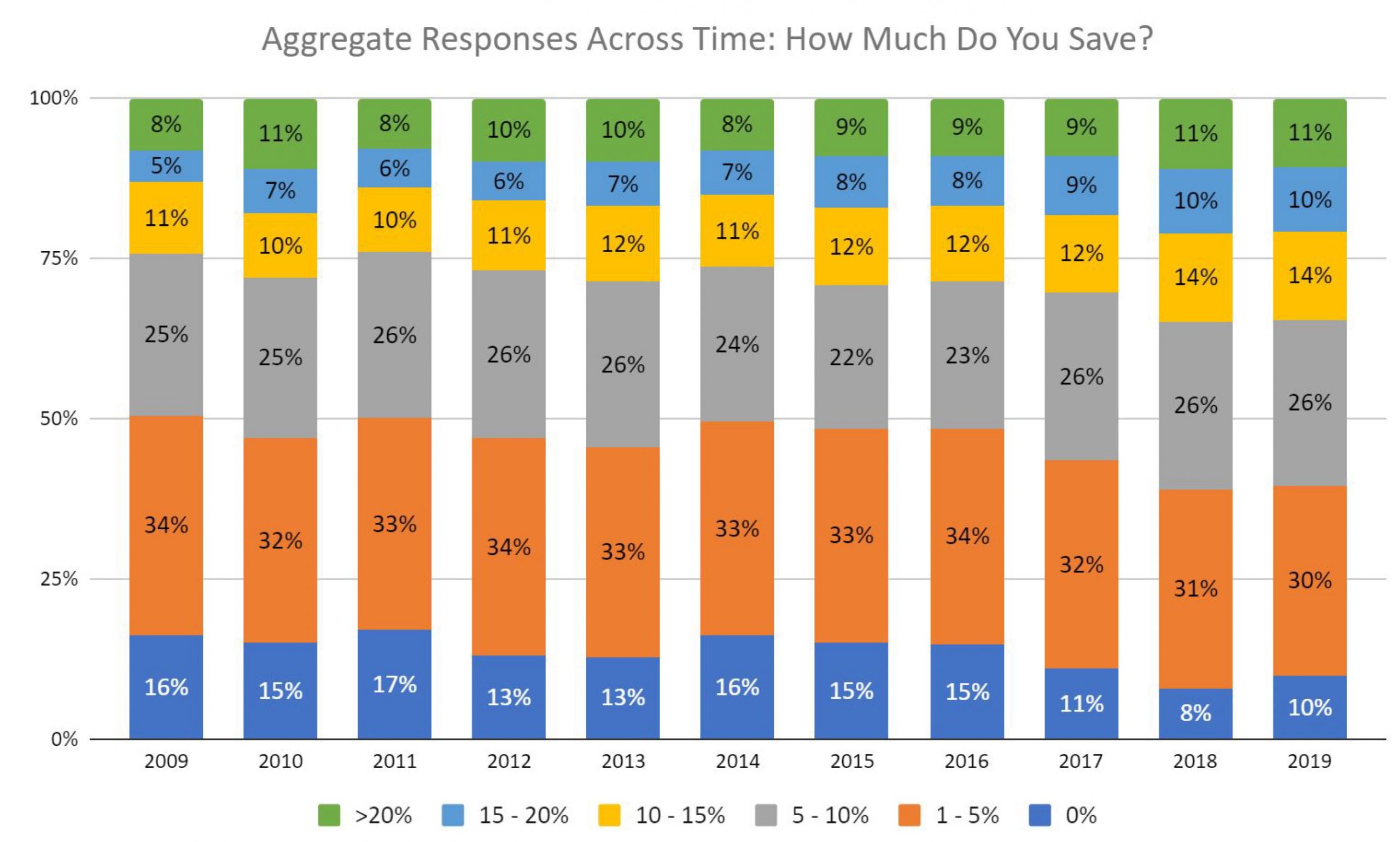

There’s a glimmer of hope when you look at the below chart from the CPA study. Check out the trend line of the dark blue – 0% savings rate. As you can see, in 2009 16% of Canadians reported not saving at all, while in 2019 only 10% reported having no savings. Other than that, it looks like we have work to do as the chart hasn’t really changed much from 2009 to 2019. Have a look and see for yourself.

Source: https://payroll.ca/PDF/Learning-about-Financial-Well-Being-in-Canada-De.aspx

So how do we improve the financial well-being of Canadians?

- Talk about money. Make sure to have regular money dates with your partner so that one of you isn’t feeling alone in being burdened by your financial position. You should both be well informed about where you stand. Have kids? They start to learn their money skills from you. Don’t shield them from your family’s finances. Talk to your kids about money.

- Reach out for help. Your investment advisor can help you no matter what your situation. Your advisory team can look at your household’s specific situation and make a plan to help you reach your financial goals.

- Start by simply paying yourself first. Start an automatic withdrawal from your bank account to either your savings or your debt (or both!). Have it run the day after you are paid. If the money isn’t in your bank account, you can’t spend it.

- Don’t stress. Your financial situation is what it is. You’ll do better in future and all will be well in time.

No matter whether we have too much debt, or aren’t saving enough, judging by this survey, the financial well-being of Canadians has room for improvement. So, make a plan in 2020 to see your financial position more clearly and do something to improve it. After all, even if you get that raise you’ve been asking for, it might not be your saving grace. Remember that nearly 20% of those with higher household incomes (>$150,000) were classified as “financially stressed”.4 It’s not how much you earn, but how much you save that matters.

Sources:

1,2, 4 https://payroll.ca/PDF/Learning-about-Financial-Well-Being-in-Canada-De.aspx

3 https://www.advisor.ca/news/industry-news/canadians-agree-they-have-too-much-debt/